Visualising Ghana's 2016 Budget Revenues

Every year the Finance Minister of the government of Ghana reads the nation’s budget to parliament. Parliament’s approval is needed before the Appropriation Bill is passed. The budget usually consists of national revenue and expenditure: the amount of money to be spent and on what it will be spent. Most Ghanaians are concerned about what the government spends on, as they are about how government generates revenue. So in this post, we will focus on government revenue for Ghana’s 2016 budget.

The government generates revenue both internally and externally. Revenue coming in from external sources have always been in the headlines and in political discussions all over the country. This is mainly due to government’s over-reliance on grants from international bodies which further plunge the country in the pool of debt it is already in. Therefore anytime there is news concerning grants and aids received by government, most people tend to be rather concerned.

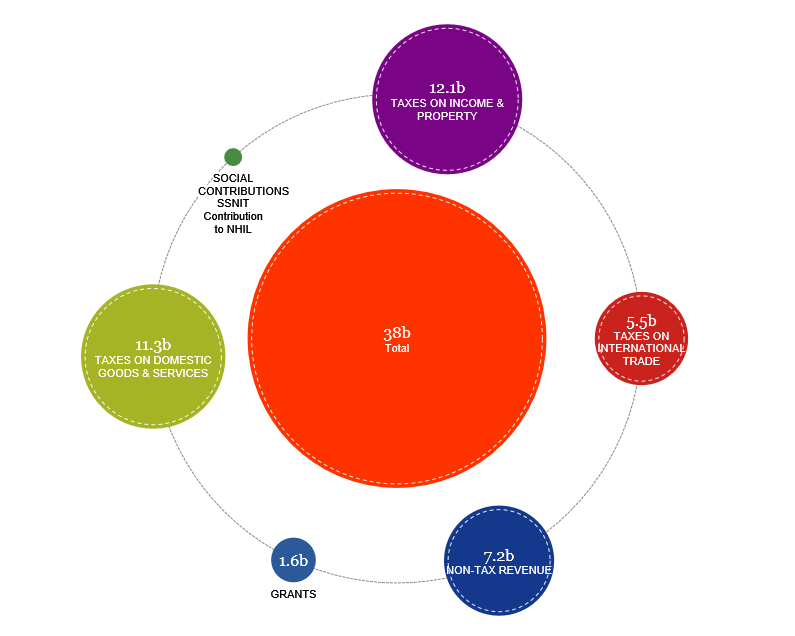

Revenue budget consists of the revenue receipts of the government which is made up of tax revenues and non-tax revenues. Tax revenues refer to the proceeds of taxes and other duties levied by the government and its agencies. And non-tax revenues refer to the income earned by government from sources other than taxes.

A close study of the 2016 Budget Appendix reveals that government’s greatest source of revenue is Taxes. Tax revenue is categorized into Taxes on income and property; Taxes on domestic goods and services and Taxes on International trade. The non-tax revenue sources also contribute quite significantly to the budget revenue. They are also categorized into Collection, Lodgement and Retention. The critical questions we would like to ask are: To what extent can the government achieve its revenue target and use it prudentially? Are these sources enough?

Please share your ideas and thoughts in the comment session.

Below is an interactive bubble that reveals the 2016 budget revenue of Ghana.